New York State Itemized Deductions 2024 – You can claim itemized deductions on your New York tax return You are not claiming New York state’s noncustodial parent earned income tax credit. New York’s earned income credit is equal . However, insurance and depreciation on the car aren’t deductible. Limit on Itemized Deductions for High Income Taxpayers Repealed for 2018 Through 2025 The Tax Cuts and Jobs Act of 2017 repealed .

New York State Itemized Deductions 2024

Source : www.tax.ny.gov7 Things New York Taxpayers Need To Know Before Filing in 2024

Source : nutfieldnews.net2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgFree Tax Clinic Bethpage VITA at Touro Law University – Nassau

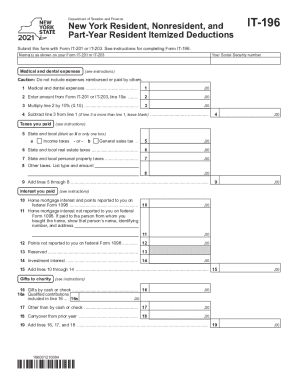

Source : www.nslawservices.orgNY IT 196 2021 2024 Fill and Sign Printable Template Online

Source : www.uslegalforms.comNew York Security Deposit Laws: What’s new in 2024 | PayRent

Source : www.payrent.comMore than 700K Michigan households getting tax credit checks in 2024

Source : www.clickondetroit.comComments on New York City’s Executive Budget for Fiscal Year 2024

Source : comptroller.nyc.govTax tables for Form IT 201

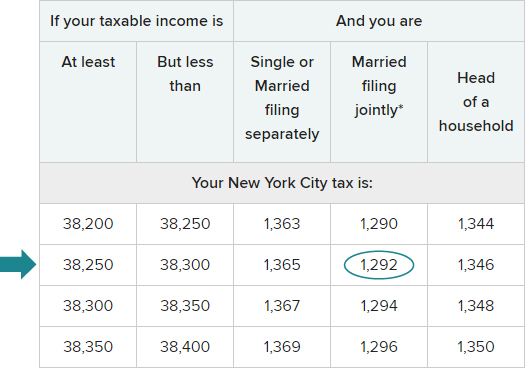

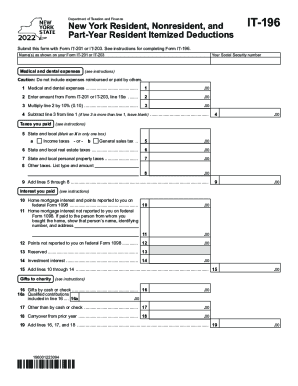

Source : www.tax.ny.govNY IT 196 2022 2024 Fill and Sign Printable Template Online

Source : www.uslegalforms.comNew York State Itemized Deductions 2024 Form IT 2104 Employee’s Withholding Allowance Certificate Tax Year : The House Rules Committee approved a bill led by New York Republicans on Thursday that would increase the state and local tax (SALT) deductions cap, setting up a potential floor vote on the . Our stories are reviewed by tax professionals to ensure you get the most accurate and useful information about your taxes. For more information, visit our tax review board. Our experts answer .

]]>